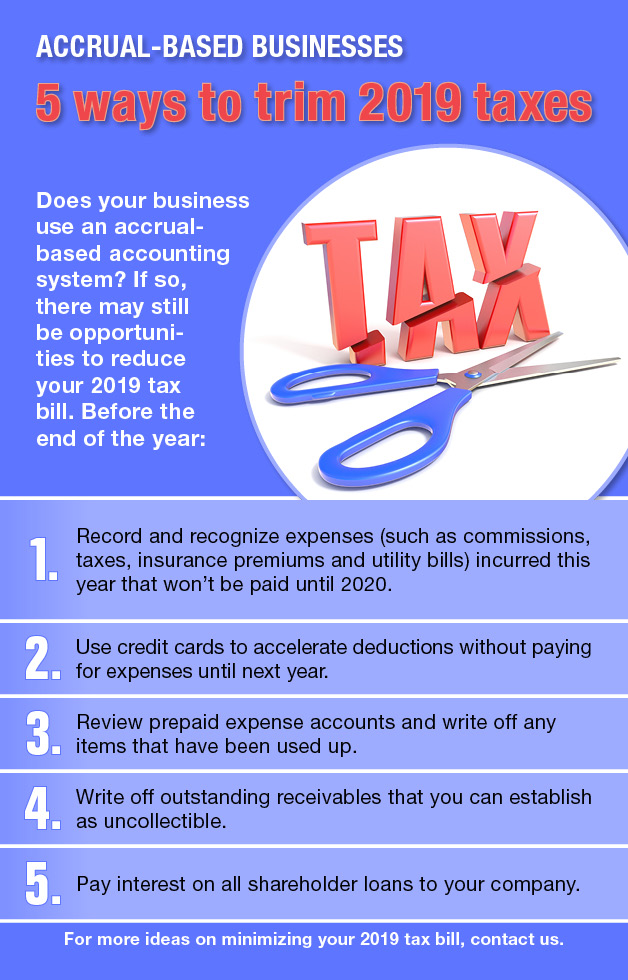

If you’re starting to fret about your 2019 tax bill, there’s good news — you may still have time to reduce your liability. Three strategies are available that may help you cut your taxes before year-end, including:

If you’re starting to fret about your 2019 tax bill, there’s good news — you may still have time to reduce your liability. Three strategies are available that may help you cut your taxes before year-end, including:

As we all know, medical services and prescription drugs are expensive. You may be able to deduct some of your expenses on your tax return but the rules make it difficult for many people to qualify. However, with proper planning, you may be able to time discretionary medical expenses to your advantage for tax purposes.

For tax purposes, December 31 means more than New Year’s Eve celebrations. It affects the filing status box that will be checked on your tax return for the year. When you file your return, you do so with one of five filing statuses, which depend in part on whether you’re married or unmarried on December 31.

You can reduce taxes and save for retirement by contributing to a tax-advantaged retirement plan. If your employer offers a 401(k) or Roth 401(k) plan, contributing to it is a tax-wise way to build a nest egg.

There’s a tax-advantaged way for people to save for the needs of family members with disabilities — without having them lose eligibility for government benefits to which they’re entitled. It can be done though an Achieving a Better Life Experience (ABLE) account, which is a tax-free account that can be used for disability-related expenses.

Are you charitably minded and have a significant amount of money in an IRA? If you’re age 70½ or older, and don’t need the money from required minimum distributions, you may benefit by giving these amounts to charity.

If you’re planning to sell assets at a loss to offset gains that have been realized during the year, it’s important to be aware of the “wash sale” rule.

Read More

There are several ways to save for your child’s or grandchild’s education, including with a Coverdell Education Savings Account (ESA). Although for federal tax purposes there’s no upfront deduction for contributions made to an ESA, the earnings on the contributions grow tax-free. In addition, no tax is due when the funds in the account are distributed, to the extent the amounts withdrawn don’t exceed the child’s qualified education expenses.

Read More

“Thousands of people have lost millions of dollars and their personal information to tax scams,” according to the IRS. Criminals can contact victims through regular mail, telephone calls and email messages. Here are just two of the scams the tax agency has seen in recent months.

Read More