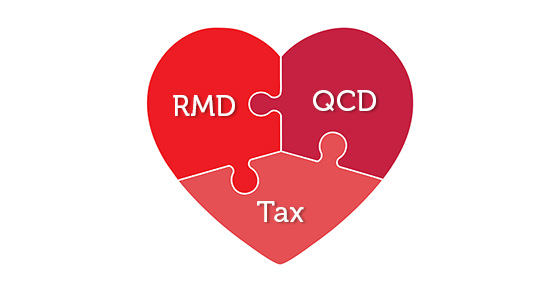

You likely have a lot of things to do between now and the end of the year, such as holiday shopping, donating to your favorite charities and planning get-togethers with family and friends. For older taxpayers with one or more tax-advantaged retirement accounts, as well as younger taxpayers who’ve inherited such an account, there may be one more thing that’s critical to check off the to-do list before year end: Take required minimum distributions (RMDs).

Read More