The May 17 deadline for filing your 2020 individual tax return is coming up soon. It’s important to file and pay your tax return on time to avoid penalties imposed by the IRS. Here are the basic rules.

The May 17 deadline for filing your 2020 individual tax return is coming up soon. It’s important to file and pay your tax return on time to avoid penalties imposed by the IRS. Here are the basic rules.

The housing market in many parts of the country is strong this spring. If you’re buying or selling a home, you should know how to determine your “basis.”

When you file your tax return, you must check one of the following filing statuses: Single, married filing jointly, married filing separately, head of household or qualifying widow(er). Who qualifies to file a return as a head of household, which is more favorable than single?

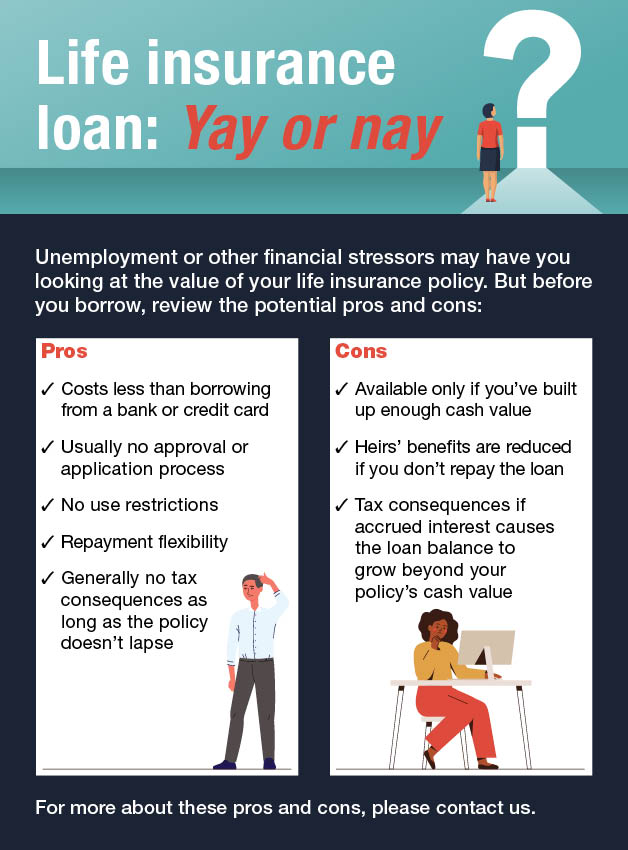

If you have a life insurance policy, you may want to ensure that the benefits your family will receive after your death won’t be included in your estate. That way, the benefits won’t be subject to federal estate tax.

The American Rescue Plan Act, signed into law on March 11, provides a variety of tax and financial relief to help mitigate the effects of the COVID-19 pandemic. Among the many initiatives are direct payments that will be made to eligible individuals. And parents under certain income thresholds will also receive additional payments in the coming months through a greatly revised Child Tax Credit.

Here are some answers to questions about these payments.

If you’re getting ready to file your 2020 tax return, and your tax bill is higher than you’d like, there might still be an opportunity to lower it. If you qualify, you can make a deductible contribution to a traditional IRA right up until the April 15, 2021 filing date and benefit from the tax savings on your 2020 return.

If you’re like many Americans, letters from your favorite charities may be appearing in your mailbox acknowledging your 2020 donations. But what happens if you haven’t received such a letter — can you still claim a deduction for the gift on your 2020 income tax return? It depends.