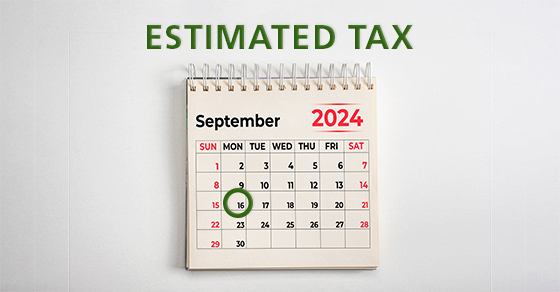

Tuesday, April 15 is the deadline for filing your 2024 tax return. But another tax deadline is coming up the same day, and it’s essential for certain taxpayers. It’s the deadline for making the first quarterly estimated tax payment for 2025 if you’re required to make one.

Read More